Web3 Xave Finance helps fintechs from emerging markets to leverage DeFi for real time remittance transfers and high yield consumer savings.

With a goal of introducing this innovative Web 3.0 product to the Web 2.0 market, our team at GK Labs helped them with their branding and content marketing efforts.

The Challenge: Bringing a Web 3.0 technology to Web 2.0 fintechs as traditional fintechs and banks are reaching their threshold

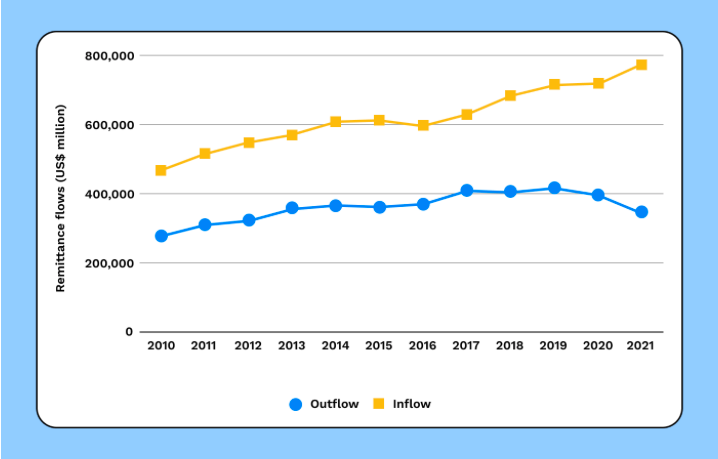

Over the past decade, there has been a substantial rise in both the amount of money sent and received through remittances worldwide. Fintech companies are engaged in intense competition to provide the most efficient and cost-effective international money transfer services across the globe.

While the average costs of international remittances have been decreasing annually, they have not yet exceeded the 1% threshold. The demand for faster and more affordable remittance services is clearly increasing, but traditional financial systems are struggling to achieve a significant leap forward in terms of improvement.

The Solution: Helping fintechs break beyond 6% p.a. through stablecoins with Web 3.0

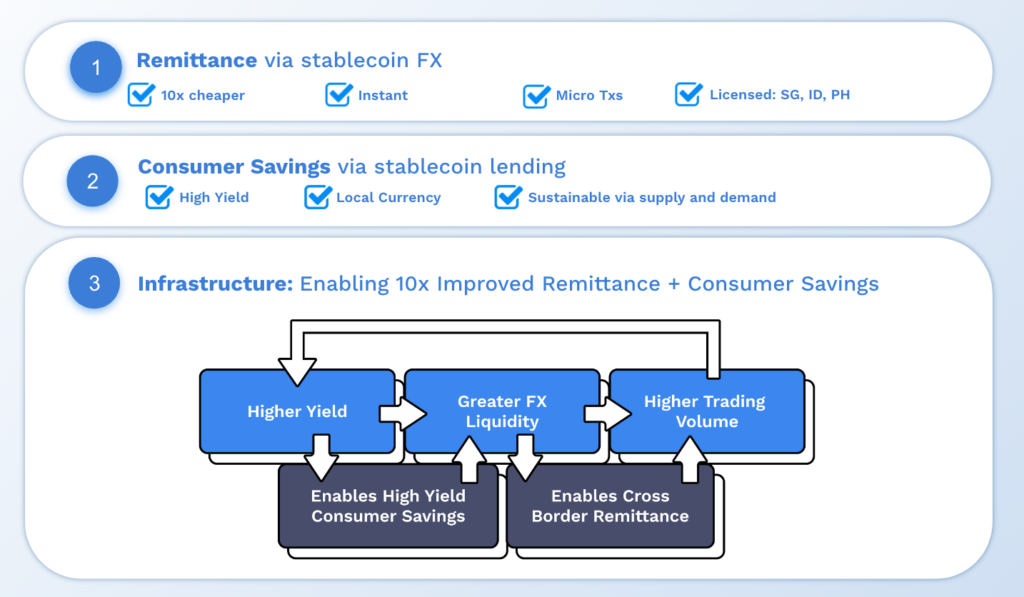

XC Labs, the Web 3.0 studio behind the product, developed a system through Xave Finance that allows them to attract fintechs on the promise of competitiveness for their customers. With advancements in DeFi infrastructure, the progress of Layer 2 technology, expanded availability of oracles, and the increasing adoption of stablecoins backed by currencies other than USD, Xave is now able to provide improved avenues for cross-border remittance and offer businesses higher-yield savings options.

Xave has consistently aimed to establish sustainable mechanisms for generating yield and ensuring liquidity for local stablecoins.

Explore Xave’s offerings here.

You need a partner to propel your Web 3.0 product to a wider recognition.

Xave Finance’s story can be yours, too. If you’re a founder with an idea or product ready to launch or scale, we can start your journey to growth today.