+300%

increase in transaction

100

users acquired in the first 8 months

Y Combinator

Admitted into their acceleration program

The Client

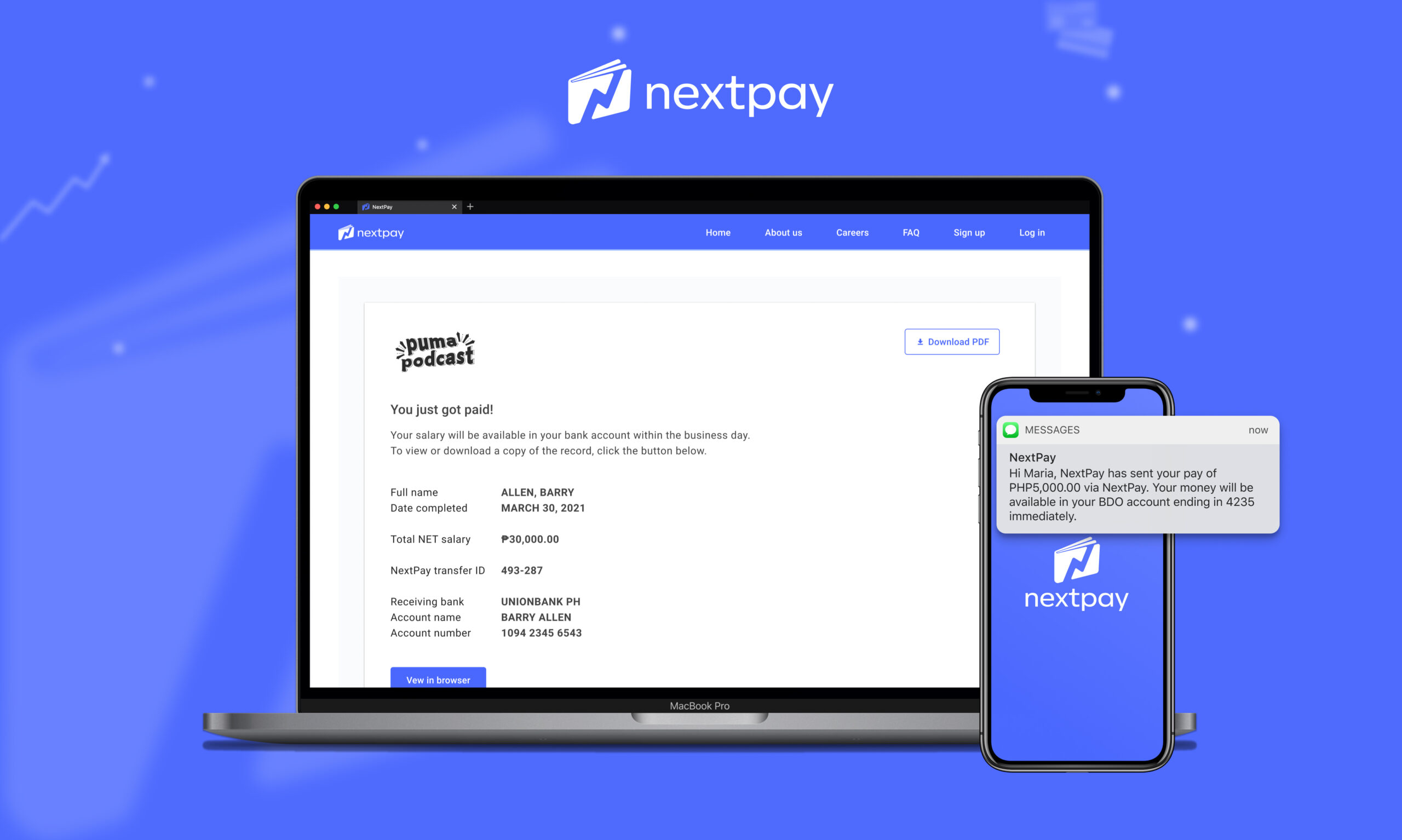

NextPay, the fast-rising payment app, defied the odds and began from scratch in 2020 without any branding, strategy or digital growth roadmap. NextPay empowers MSMEs to automate the collecting, sending, and managing of money—all in one powerful platform. They provide easy-to-use financial services without high fees and stiff barriers to entry. Since 2020, over 3,000 Filipino entrepreneurs have trusted NextPay to help them simplify their financial operations.

Learn how they became a market leader in just a few short years by targeting the right customers with an acquisition strategy.

Services

Product Marketing including Go-to-Market Strategy

The Challenge: Building the right customer acquisition strategy

When NextPay approached the founding member of our team, they needed help to setup their growth & marketing team, and develop the following aspects of their Go-to-Market strategy:

- Customer Discovery & Insight – NextPay didn’t identify their user problems solutions when they started their Day 1. The goal was to validate the customer acquisition hypothesis, and to assess its potential to generate revenue.

- Customer Validation – With no defined target users or ideal customer persona (ICP) profile, acquiring customers proved challenging. Do their customers have an actual need for the product? Will they use it? If they do, how often? Are they targeting the right people? Who should they target first? They needed to validate their customers in order to understand who their early evangelists were and will the product features appropriately reflect their needs.

- Product-market (P/M) fit – It is crucial to validate that there is sufficient demand for NextPay’s product before shifting their team’s focus to other strategic objectives like growth or upselling existing users. Not establishing that NextPay’s product has a viable market to generate revenue and make a profit would mean that pursuing these initiatives may be detrimental, or unsustainable. Therefore, it was clear that we had to help NextPay ensure that there was enough interest in the product to sustain it in the market.

The Insight: The most cost-effective customer acquisition strategy

Our founding member helped them build a go-to-market plan that primarily focused on a cost-effective customer acquisition strategy. We provided and developed a customer development framework that helped the team validate product ideas and build a product development roadmap that solve customers’ problems. Through a series of in-depth interviews (IDIs), we worked with the team as they interpreted the feedback of existing and potential customers. This helped us understand why and whether they’re willing to pay for a payment app such as NextPay.

Customer insighting and growth acquisition, done simultaneously with product development, allowed NextPay to be time and cost efficient. This was due to the guidance provided to the team in executing well-tested ideas. Besides cutting down on the learning curve, it also removed emotions and bias from the decision-making process. Finally, it helped the team achieve its product-market fit faster.

Overall, the right customer acquisition strategy enabled NextPay, now a well-loved payment app, to avoid the feature fallacy trap and build products their customers love.

Explore Nextpay’s offerings here.

You need a partner.

NextPay’s story can be yours, too. If you’re a founder with an idea or a product ready to launch or scale, we can start your journey to build a solid customer acquisition strategy for your product today.